Sometimes, all that stands between an entrepreneur and a successful business is the means to finance an idea. Without cash in the bank, wealthy investors or a loan, the business may remain just a dream. Finding the best way to get start up funding can be the difference between a dream realized and one lost.

In this post, we explain the basics of some of today’s most popular and reliable ways to fund a security start up or other business, with a special focus on 401(k) business financing, known as ROBS. These options are being used by smart entrepreneurs to put their businesses on firm financial footing from the start.

Start Up Funding 101: 4 Options

Following are four funding options recommended by financial advisors at Guidant Financial, who specialize in helping small business entrepreneurs take the first step in financing their ideas.

1) Rollovers for Business Start Ups (ROBS)

This option involves using existing 401(k) funds to invest in a new, owner-operated business. The financing is arranged through what is known as a Rollover for Business Start-ups (ROBS). With this arrangement, you can invest your money into a small business or franchise without taking a loan or a taxable distribution.

Regardless of whether your plan is to start a new business, buy into an existing one or expand the one that you already have, ROBS can inject a significant amount into your venture. Most savings plans are eligible for this, including 401(k), 403 (b), traditional IRA, Keogh, TSP and SEP.

To understand the steps in the process of the ROBS option, see our related blog post here. There are a number of advantages of choosing to go with ROBS to fund a security start up:

- Returns are seen sooner. When a business is started without incurring debt, overheads are reduced and the risk of putting up assets like your home are eliminated. When there is no cost of loans in form of interest, you see returns on your investment sooner.

- Tax-deferred savings. With the need to take a taxable distribution eliminated using this option, you can put aside more funds for retirement.

- Confidence. This is an investment that you can manage and control much better than traditional investments like the stock market, which is constantly up and down. It is essentially an investment in yourself and in your ability to mitigate risks, minimize expenses and maximize returns.

- Peace of mind. If you choose to go with this option to fund a security start up, you can do so with the peace of mind of knowing that it is a funding option that has been recognized by the Employee Retirement Income Security Act (ERISA) which was enacted in 1974. The Act passed the responsibility of retirement saving from employers to employees.

Understand that certain financial advisors and stock brokers may not be aware of ROBS or may not advise their use because they don’t give their institutions high returns.

ROBS can be used to purchase or start most types of businesses or franchises. There is one exception and it would be using the capital to fund a business that is considered to be one where your only input would be an investment of capital. An example would be starting a business whose core activity would be loaning others money from your retirement fund. ROBS can be combined with other solutions, including those explained below, including securing portfolio loans, unsecured loans and for equipment leasing.

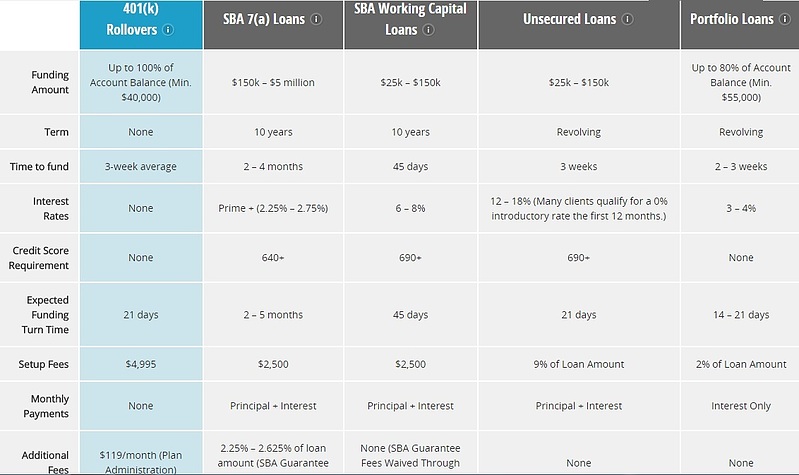

Here’s a helpful comparison chart that shows the features of the four options outlined in this post:

Source: GuidantFinancial

Source: GuidantFinancial

2) Small Business Administration (SBA) Loan

This is a more traditional type of business loan that offers fairly low interest rates and reasonable terms of payment. This option can be combined with other financing options, such as ROBS, and is a smart option for owners who are buying an existing business or investing in a security franchise, for example.

Different types of SBA loans, including working capital loans and SBA 7(a) loans offer different funding amounts, timeframes for funding, fees and interest rates.

3) Portfolio Loan

A portfolio loan allows you to borrow up to 80% of the value of your own stocks, bonds, mutual funds and other securities. The loan works like a revolving line of credit, allowing you to borrow at various times when you need funding. The benefits of portfolio loan include quick funding turnaround, no out-of-pocket costs and low interest rates.

4) Unsecured Loan

Unsecured loans can help with start up funding by serving basically as a business credit card. This type of loan is available without having to present your personal property as collateral, so your personal property risk may be lower, although interest rates tend to be higher than other options reviewed in this post. There are no requirements on the use of the funds you receive with the revolving line of credit through an unsecured loan.

Lenders will look closely at your credit history and credit status to determine your eligibility.

Fund Your Business Dreams With Confidence

With all the decisions you’ll need to make as you get your business off the ground, financing can be one of the biggest and most complex areas. Knowing your options and getting good advice can make a big difference. By choosing the right option for start up funding, your business can thrive through quicker returns an good investments.

As you determine the best way to finance your security franchise or other start up, you surely have many more questions about setting up your new venture. Our free e-book below, “Grow Your Business Using the Franchise Model,” can be your roadmap to success as you develop your franchise business plan.

Image credit: photosteve101