Joining a franchise business is a dream of many, especially when you know you are being associated with the best brands in the market. However, for your franchise dream to be a reality, you need to look for the best ways to finance your business that are available within your timing expectations.

Franchise Finance Options

With the right franchise finance plan, you will be able to have flexibility in the payment schedules and easy access to money when you need it. Below is a list of common franchise finance options which, in this article, we provide details about timing and features of each.

- ROBS (Rollovers for Business Start-Ups)

- SBA Loan

- Portfolio Loan

- Unsecured Loan

- SBA Working Capital Loan

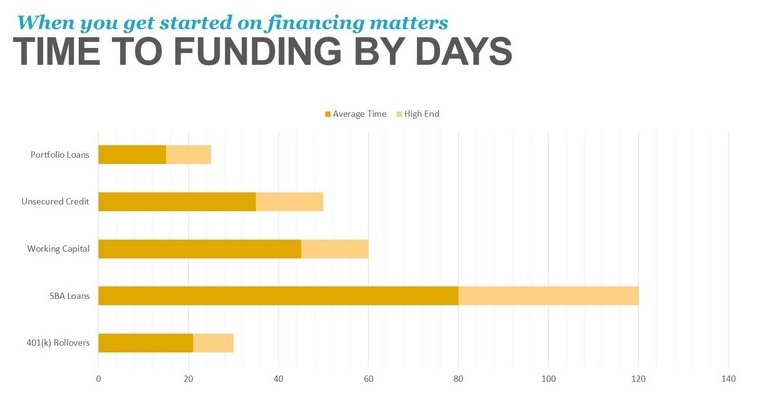

To put your financing plan on track, you need to consider the timing differences in securing various types of funding, as shown in the graph below.

Source: GuidantFinancial

Source: GuidantFinancial

As you can see in the image above, there is a broad difference in the timing it takes to secure different types of financing. The options for quicker financing, including ROBS and portfolio loans, require current ownership of certain assets. Other options have separate eligibility requirements that may either open up options or limit your financing options.

You’ll need to evaluate each option in the context of your own unique situation to allow you to choose the right option or combination of options for your franchise finance plan.

Funding Options: Features

To help you narrow down your ideal plan, below is a general description of each option listed above.

ROBS (Rollovers for Business Start-Ups: 401k rollover)

The ROBS option allows you to access existing 401k funds to finance your start-up. Being able to fund your venture and purchase products for your franchise using the funds in your retirement account can help limit the debt you take on initially for your start-up. This is not considered a loan, so you will have no debts or interest to pay. The ROBS success rate is often higher than other start-up financing plans, as your small business is not being starved to make payments for the debt.

SBA loan

SBA (Small Business Administration) is a federal agency that will help you as a small business owner gain access to loans for small businesses. The loans are from the SBA loan participating banks. The SBA will guarantee the percentages of the loan so the banks will have more incentives to lend. This means the bank will be willing to lend you money for your franchise financing, sometimes even if you do not meet the strict credit criteria.

Portfolio loan

With this loan, you can leverage your securities, such as bonds and stocks without liquidating them. You will be able to borrow up to 98% of your portfolio value. This will give you access to a revolving credit line that you can use to finance your franchise as you need it.

Unsecured Loan

The unsecured loan is an option to get financing fairly quickly that will aid your capital needs. Though you will not need to offer collateral or a guarantee for this kind of loan, you will need to have a strong business and personal history.

This loan will not distract your credit history though other avenues of financing will still remain open to you in the future. Additionally, you are able to use the funds you get in any way you see fit for the expenses of the business.

SBA Working Capital Loan

This option will help simplify your financing and will arrange a working capital loan which is not dependent on variables that are beyond your control. These variables include re –appraisal results, economic factors and financial ratio maintenance.

How Can You Ensure Quicker Financing?

To move the process of franchise financing along faster, you need to;

- Have access to all your financial statements to know what you are comfortable risking in terms of investment.

- Get pre-qualified for the different financing options to avoid disappointments or time wasted in the application process.

- Dedicate time for the application process for the financing options.

By taking these actions you will meet your financial timing goals to get the doors open and grow your franchise.

Franchise Financing Tips

- Be totally honest with the lenders and be prepared to give an explanation for everything you present.

- Seek lenders who understand franchises and small businesses.

- Fill out the loan application forms clearly and completely, typed if possible.

- Do not exhaust liquidity by paying debts before you have made an application for a loan. (The lenders will want you to have capital).

- Keep your debts and expenses to a minimum.

Conclusion

Timing is important when launching your new business. While many decisions will need to be made, how you’ll finance your venture will be one of the most important. The more options you have, the more control you’ll have over the timeline for putting your finance plan in place.

Be sure that you have an understanding of your investments and a complete picture of your financial situation as you decide about the best financing option for you. There will be ups and downs in your business, but having your finances in order will help you become a long-term and successful business.

Interested in the franchise model? Check out our free e-book below for a roadmap to franchise success.